In Defense of Electricity Markets

Electricity markets are often maligned but they are the best option for handling changing electricity generating technology.

Electricity Markets in a Time of Change

Creation and Evolution

Brian Potter has an excellent overview of how electricity markets came to be on his Substack. The short version is that they evolved slowly over many decades, and full wholesale market liberalization started in the late 1990s. Markets manage roughly 2/3 of US electricity generation. The Southeast and much of the West still use vertical monopolies. The process is ongoing - many utilities in the West will join Southwest Power Pool in the next few years. Monopolies still own the distribution system that delivers electricity to your home everywhere.

The slow evolution and need to preserve reliability means markets are a mashup of rules. Technical debt is rife, and many rules aren't well suited for new generation sources like solar or batteries - or sometimes even natural gas.

Many wonder if we should even use electricity markets! I will explain how technology is improving markets, allowing for the deployment of low-cost but inflexible resources, and increasingly checking monopolies through competition.

Inflexible Supply and Clearing Markets

Electricity demand has traditionally been inelastic in the short run - customers use electricity with no regard for the current cost to supply electricity. Supply has been more elastic - with reservoir-based hydro, gas, oil, and coal power plants ramping up and down with demand. Electricity prices are sleepy in these markets. Efficient plants with low fuel/opportunity costs usually set the price, and prices rise slightly to bring on less efficient plants during peak hours.

The trend is towards less flexible resources like solar, wind, nuclear, and geothermal. Power plants of these types have low marginal costs, encouraging them to run flat out. Electricity prices decrease during the vast majority of hours as these sources gain market share but can spike when supply is tight because fewer high marginal cost producers are available.

Natural gas has rapidly expanded its market share in electricity generation and brings different complications. These facilities require constant fuel delivery by pipeline instead of storing it onsite like coal, oil, hydro, or nuclear power plants. Pipeline disruptions can force power plants offline, and buying natural gas is also a real-time market. The natural gas price can skyrocket during peak gas demand, which requires higher electricity prices to justify the operation of natural gas power plants. A coal or oil power plant buys its fuel ahead of time at everyday prices. Nuclear and geothermal power plants also buy fuel ahead of time, but their high fixed and capital costs make them less cost-effective at load following.

Over the last fifty years, the US has moved from coal and oil-dominant grids to power plants that need more sophisticated planning, like gas, nuclear, solar, and wind. That complexity is the price of using cleaner, cheaper, and less flexible sources.

New Technology Means Smoother Sailing

Electricity markets are very challenging with analog technology. Electricity is expensive to transport, and different restrictions or bottlenecks can create divergent conditions a few miles apart. Wholesale electricity markets use locational marginal pricing. Hundreds or thousands of nodes in each market have a different price. Keeping track of prices and conditions while maintaining perfect balance on the grid is a lot easier with computers. Wide-scale electricity markets rarely existed before computers and digital telecommunications became common. Similarly, new technologies can help existing markets operate more efficiently and better handle inflexible generation.

New technology can:

Increase elasticity of markets through storage and demand shifts.

Create a surge of inexpensive power capacity that reduces the risk of short-term supply shortfalls.

Provide direct competition for monopolies.

Technology improves electricity markets. Markets will never be perfect and some market types work better than others. They will allow faster adoption of technology that can lower customer prices.

Adding Flexibility

Energy Storage and changing the elasticity of demand can make markets less fat-tailed.

Storage

Storage is the traditional solution to supply and demand inelasticity. Many US utilities with nuclear power plants built pumped hydro storage. Operators fill the reservoir at night when demand is low and drain it to produce electricity during the day. Both supply and demand become more flexible because the storage unit buys when there is too much electricity generation and sells when there isn't enough. The US has roughly 30 gigawatts and 300-gigawatt hours of pumped storage (batteries are close to the power rating but still a few years from matching the storage).

Today, battery capacity is growing because its cost has fallen dramatically. Texas's grid operator, ERCOT, has 100 gigawatts of battery storage in its interconnection queue. 85 gigawatts is ERCOT's demand record. A small portion of that capacity would eliminate fretting about cold nights or summer evenings.

Batteries can shift daytime solar supply to evening or store excess nuclear power at night. They also simplify the operation of natural gas power plants. In California, Texas, South Australia, etc., thermal power plants ramp as the sun sets and solar production falls. That ramp is challenging, and the need to have all the gas power plants run at once stresses operators and the natural gas delivery system. Batteries can handle the ramp instead. Gas plants can run steadily all day to charge batteries for the evening supply if the supply is short. They have fewer starts, need less maintenance, and reduce their peak impact on gas delivery infrastructure.

Frequency regulation and deferral of grid upgrades are other areas where batteries can earn revenue. Batteries provide extremely cost-effective frequency regulation, but these markets are easily saturated. Reducing the need for power line upgrades is a bigger market. It isn't uncommon for utilities to make upgrades because a power line exceeds capacity a few hours per year. Batteries located near customers can charge during the night and reduce stress on the line during peak hours. They are typically a fraction of the cost of an upgrade. The same battery can still provide frequency and load shifting while it isn't needed to offset peak distribution demand. These "extras" mean batteries can bid lower to arbitrage daily prices and still make money.

Many power-hungry appliances like induction stoves or water heaters may have integrated batteries to reduce their impact on home electrical systems and the grid.

The affordability of batteries will determine the size of their role. ERCOT saw spreads of as much as $4000/MWh during many days of summer 2023. A several-hour grid storage battery might cost $300,000/MWh today. Less than 100 of those events would pay the system off! And the cost of stationary storage batteries should fall rapidly.

Driving Down Stationary Storage Cost

Most batteries today discharge at their max output for 1-4 hours, but longer-duration batteries (4-12 hours) should get more popular as the inflexible generator market share rises. These storage battery requirements differ from those that power Walkmans, laptops, power tools, cars, and frequency regulation.

The cost per cycle is the dominant factor instead of energy and power density. Manufacturers threw car batteries into stationary storage packs to quickly provide a product but are now pouring resources into more optimized designs. There might be half a dozen credible paths to reducing cycle cost for an everyday battery below $20/MWh - where large amounts of daily shifting are possible.

It isn't uncommon to see $10-$15/MWh electricity prices in markets during demand lulls. A cycle cost of $20/MWh would allow the purchase of electricity in off hours and still sell competitively against the $30-$35/MWh that efficient natural gas power plants can profit at.

For context, the world uses 2.6 terawatts of electricity on average at any moment. Ten hours of electricity storage globally would require 26 terawatt hours of storage. One terawatt hour per year of battery manufacturing capacity would level out at 15 terawatt hours of installed storage if a battery lasts fifteen years.

Some of the options for inexpensive stationary storage are:

Lithium Iron Phosphate (LFP)

LFP batteries are becoming the workhorse for many applications instead of NMC-style lithium batteries because they don't use nickel or cobalt, have lower fire risk, have better cold weather performance, and are often "good enough." Most stationary storage manufacturers are switching their designs to use LFP. The current cell cost is ~$85/kWh, and the total installed cost ranges from $200-$300/kWh.

The first opportunities are with the pack. Stationary storage batteries are relatively new. Manufacturing and site construction are poorly optimized. Slower charge/discharge rates would require less cooling and smaller inverters than today's packs, allowing further simplification. It could make sense to have a small portion of the batteries be "fast-acting" for frequency response while optimizing most for longer runs.

The path to lower cell costs starts with lithium prices falling close to extraction costs. There are massive low-cost resources available that rapid demand growth has overwhelmed. Prices should return near extraction cost once they catch up. Many companies want to use cheaper natural graphite instead of synthetic graphite for anodes. Separator and electrolyte manufacturers still have high margins, suggesting cost reduction opportunities as markets mature. Most manufacturers optimize cells for rapid charging. They will likely design storage cells for slower charge and discharge.

Installed costs must fall below $100/kWh to reach $20/MWh cycle costs. It is possible with optimized designs and supply chains. Factories are already nearing the ability to produce terawatt hours of LFP cells each year, and stationary storage producers aim to exceed 100 gigawatt hours per year of pack capacity.

Sodium-Ion Batteries

Sodium-ion batteries have very similar economic features as LFP batteries but can have lower material costs. Sodium is much cheaper than lithium, the anode can be inexpensive hard carbon instead of graphite, and the anode current collector can be aluminum instead of copper. They also have lower fire risk and better cold weather performance than LFP, which should make pack design simpler. Many analysts think sodium-ion batteries with cathodes optimized for low cost are the end game for daily cycling stationary storage. Cell costs could be <$40/kWh with 5000-10,000 cycles and relatively inexpensive packs. The most optimistic estimates would have cycle cost approaching $10/MWh.

There are >100 gigawatt hours of sodium-ion cell factory capacity planned, under construction, or ramping production. Two of the largest battery companies, BYD and CATL, are proponents.

High-Density Lithium Ion Batteries

Material and pack design optimization are less relevant if the cells hold 2x-5x more energy per unit of mass! Some examples might be nanolithia or lithium-sulfur. These batteries are still in the lab or pilot-scale manufacturing, making them much more speculative.

Scaling AA Batteries

A possible dark horse battery might be zinc alkaline, the same chemistry as household AA batteries. These batteries aren't usually rechargeable, but recent advances have cracked the code. The materials are inexpensive, energy and power density are serviceable, and fire risk is negligible.

Urban Electric Power is pursuing the technology. They have a well-written roadmap for reaching $50/kWh cells. The company has installed several megawatt hours worth of batteries, has several gigawatt hours of orders, and recently won a DOE deployment grant. Eliminating fire risk opens up customers that wouldn't otherwise be willing to host batteries and provides a path to scaling that isn't competing directly with more mature chemistries.

Iron-Air

Iron-air batteries are inexpensive per kilowatt hour but have low efficiency (~50%) and power density (100-hour charge/discharge), making them better suited for multi-day storage than daily cycling. There is an outside chance they compete in daily cycling markets.

Form Energy, the protagonist in the iron-air story, is building a ~50 gigawatt-hour-per-year factory. The current cost is ~$20-$25/kWh, but the active material cost is <$1/kWh, leaving plenty of opportunity for cost reduction. The poor efficiency and power density are related to the difficulty of catalyzing the oxygen reactions. Any improvements could lead to better performance, but it's important to emphasize that metal-air batteries are challenging to improve. Reducing costs by eliminating non-active materials and improving manufacturing will be much easier.

Some combination of low electricity purchase costs, decreased cost, and better performance could allow iron-air batteries to compete in the daily 10-15 hour storage market by using a small portion of its storage capacity. The excess storage could operate when supply is short over multiple days. A 50-hour iron-air battery that costs $10/kWh with 65% efficiency buying $10/MWh electricity might have a ~$15/MWh cycle cost.

Thermal Storage

Thermal storage in bricks could repower existing combined cycle power plants or even new builds. Lower efficiency (~60%) makes this technology better suited for multi-day storage, but it can be surprisingly competitive for daily cycling with a 16-hour discharge.

A daily cycle could be under $30/MWh if we assume $6/MWh of electricity losses (purchasing off-peak electricity at $10/MWh) and Lazard's new build combined cycle LCOE. Repowering existing facilities might be under $15/MWh.

Rondo Energy is the furthest among the brick storage startups and is building a 90 gigawatt-hour-per-year factory. The fact that you can reconfigure mature technologies like combined cycle power plants and refractory bricks to produce affordable solutions shows that daily storage is a race to the bottom.

What the Cat Dragged In

I don't find technologies like flow or zinc-bromine batteries as compelling. But I can't completely discount them, nor the constant stream of new concepts that might produce a few winners.

It seems like it will only be a matter of time before one or more of these technologies break the $20/MWh barrier and impact electricity markets. The manufacturing capacity under construction is already significant.

Handling Seasonal Demand

There is a lot of talk about what firm power, transmission, or seasonal storage resources are required to maintain reliability. Usually, the conversation assumes a 100% renewable or carbon-free grid. Existing natural gas power plants, which can deliver electricity for $35-$50/MWh only running 10% of the time, must be displaced by more affordable resources in any market construct regardless of what pundits think.

Existing natural gas power plants can meet seasonal demand. Hydro and nuclear power plants further add to reserves. Long-term storage technologies like heating gravel piles could end up being competitive. May the lowest-cost resources win.

Exposing Customers to Prices

Demand has been inflexible because utility customers rarely pay real-time prices outside limited programs. Instead, they are charged one price based on a longer-term average. There is no incentive to curb power usage when hourly prices are high.

The US has ~1300 gigawatts of electrical generation. Utilities only have ~60 GW of demand response signed up. Most of that is from commercial and industrial customers. Price extremes tend to come during hot or cold weather, and customers prefer being comfortable even if it costs more. Most utility demand response programs have been a disappointment. Additionally, customers exposed to market prices during Winter Storm Uri kept running their heaters and didn't pay their bills, causing electricity providers like Griddy to declare bankruptcy.

A demand response program in Arizona has seen more success. It is much simpler in that customers earn a yearly flat payment ($35) for turning their AC off during peaks and get a discounted smart thermostat when they sign up. There is no penalty for opting out of any event. Other helpful factors are that the critical hours are much shorter for solar-dominated grids, only 2-3 hours after sunset instead of all afternoon. It works even better if the home is "pre-cooled" to a lower temperature during the day when there is an electricity surplus. Utilities can even stagger when air conditioners start or pre-cool to steady demand. NRG has had similar success in Texas on a smaller scale.

Electric water heaters have long been in demand response programs, but new upgrades improve their ability to shift energy based on real-time conditions without leaving customers with cold water. Roughly 18% of household energy goes towards water heating, though many buildings still use fuels like natural gas.

Electric cars should be a "no-brainer" for improving demand flexibility. Cars park over 90% of the time, and they can charge when electricity is cheap and refrain when it is expensive. Customers can save money without suffering. Most electric car drivers do not use a full charge, allowing them to forgo charging on some days without altering their behavior. Charging could be up to 1/3 of electricity demand if everyone drives electric cars!

Demand response is another type of storage. Few consumers will sweat it out or give up the ability to use their car. But they will sign up if you shift when their car charges or the AC runs without dramatically altering their experience. Few states have more than 10% of demand in response programs, and some have zero. Harnessing the residential sector and electric vehicles could increase demand response capacity by 5x-10x. But batteries and demand response are substitutes. Cheap batteries will limit customer payments and participation.

Altering Demand Patterns and Limiting Spikes

Most demand spikes are weather-related. The job of grid managers and market participants would be easier if the weather did not exact such a toll. Structural changes to demand are often more effective than altering behavior when trying to flatten demand.

California is experimenting with programs to reduce peak demand on summer afternoons and evenings. One of the primary programs subsidizes efficiency and time-shifting demand. The critical feature is that home efficiency contractors get paid by performance, measured by a home or business's digital electricity meter. These programs previously paid by "modeled" savings, which are much easier to game. Now contractors are hunting down houses in the Central Valley with old, inefficient air conditioners or putting LED lights in stores that stay open during the evening. The program also allows payments even if electricity use increases (like from replacing a gas furnace with a heat pump) as long as demand decreases during critical periods. A solution like this is less pure than subjecting customers to severe market prices, but it does reduce counterparty risk and short-termism from owners and renters.

Improving building performance may be one area that could justify an influx of government subsidies because the politics of electricity supply failure during extreme events are toxic. The after-effects will almost certainly make market design worse. For instance, Maine wants citizens to switch from oil heating to air-source heat pumps. Ground source heat pumps cost more but might use ~1/4 of the power in the worst cold snaps. Peak demand would be much more manageable than with air-source heat pumps. Another example is homes with resistive electric heaters in Southeast Texas. Pushing these homes to more efficient air-source heat pumps would reduce the stress cold snaps put on Texas's grid.

A flatter demand profile eases the strain on power plants, reduces the need to invest in seasonal peaking capacity, and helps accommodate low marginal cost generators. Creating incentives around common demand patterns is a more durable approach to tackling daily and seasonal swings in demand that stress the electricity supply.

What Type of Market is Best?

Differing Market Mechanisms

Electricity markets are political battlegrounds. There is a constant tension between efficient markets and goals like helping favored entities, using specific generation sources, or maintaining excess capacity. Capacity markets where qualifying generators get paid for existing are one tool. PJM has the most famous capacity market. It doles out several billion dollars each year. The idea is to make sure there is capacity available for peak events. Many of these plants receiving payments didn't run during winter storm Elliot, and PJM is fining them for poor performance.

The most famous alternative is ERCOT's energy-only market. Electricity prices alone provide the incentive for producers to increase supply. ERCOT also has tools to maintain supply and reserves like a stealth capacity market, but the margin is typically lower than PJM. The energy-only model is less prone to manipulation but took a reputation hit after winter storm Uri.

The beauty of energy-only is that generators automatically get paid when the grid needs them the most, and they miss out on the most profitable hours if they can't run. A peaker plant in Texas might make all of its yearly profit in a few hours. Electricity traders offer hedging that can spread these earnings over time. The signal is much more direct than capacity payments or fines and is technology-neutral.

The Case for Energy Only Markets

An alternative view of ERCOT's reliability woes during Uri could be that the grid was uniquely vulnerable to extreme winter weather as it shifted away from coal to gas/wind but before significant amounts of batteries came online. Texas's lack of connections to the wider US grid also hampered its ability to import electricity. Other market structures with high natural gas market share without many batteries are also vulnerable to load shedding, as seen with Elliot. Energy-only markets deserve more consideration, especially with rapid supply additions and load growth.

Some benefits of energy-only markets are:

Faster Adoption of New Technology

Monopoly utilities have little incentive to adopt new technology. Almost any wholesale market will create better opportunities for new technologies. Energy-only markets are often the most accommodating because they lack the complicated rules and subsidies seen in capacity markets that may not fit well with new generation.

The incredibly successful "Beyond Coal" campaign was only possible because independent power producers building alternative power plants provided the data to show state regulators that utility models were biased towards new coal power plants.

Faster Deployment of New Resources

ERCOT uses "connect and manage" to add new capacity. Power plant developers apply for a location and pay for their local connection to the grid. ERCOT reserves the right to curtail production if there is grid congestion. The developer assumes the risk of curtailment, but the interconnection process is faster than any other grid operator.

Most grid operators use a more involved interconnection process. They study how a new power plant will impact the entire system with the goal of very little curtailment. Developers can be on the hook for transmission upgrades far from their proposed facility to alleviate any chance of congestion. Capacity markets aren't effective without these studies because grid congestion could prevent participants from selling power. Connecting new power plants is slower and more expensive.

Better Allocation of New Resources

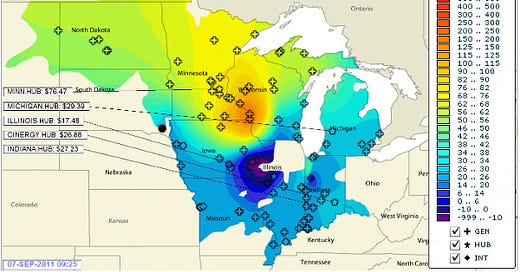

Electricity prices can vary significantly across space and time. These dislocations exist because of transmission constraints, overgeneration from low marginal cost sources, or lack of local capacity. The prices tell developers exactly where to place new power plants or hunt for demand response resources. Any side market that blunts node pricing weakens discovery.

Prices vary; Source: EIA

Smoother Management of Power Plant Turnover

Vertically integrated utilities often struggle with minimizing costs to customers when handling power plant turnover. Hawaii closed its only coal power plant before replacement solar and storage projects were ready to replace it. Ratepayers suffered because the utility burned more oil to compensate, and prices spiked because of the Russian-Ukrainian war. Many other utilities have held onto coal power plants instead of switching to cheaper gas, solar, or wind.

Markets with capacity markets and other gadgets tend to favor the status quo by maintaining old capacity.

Energy-only markets have the fewest barriers to change, but grid operators like ERCOT reserve the right to declare some power plants as critical and delay their retirement.

Better Handling of Extreme Events

Many gas power plants in PJM sat idle during winter storm Elliot. They chose not to run because their fuel cost exceeded the price cap PJM imposes on markets. A functioning market would pay producers enough to buy fuel. And penalties should be immediate (lost revenue) instead of fines that politically connected electricity producers can lobby to cancel.

Price flexibility is especially critical during cold snaps when the natural gas supply is tight, and spot gas prices can spike dramatically.

Easy Entry for Non-Traditional Entrants

Demand response and batteries are technologies where clunky rules can inhibit deployment. Energy-only markets are much more technology-neutral.

Improving and Trusting Markets

Markets handle complexity far better than single organizations, but our electricity markets need more work.

Market Flaws Can Hurt Reliability

Market glitches have damaged supply during critical events over the past few years.

California provides one of the most famous cases where poorly written market rules led to a crisis in 2000-2001.

Another example was Uri, where ERCOT manually set market pricing. Markets saw ERCOT's load shedding as a decrease in demand, which then lowered prices when supply was critical. ERCOT set the electricity price to the maximum for several days, exacerbating customer utility bills.

A related issue is that natural gas supply markets are often not granular enough for power plants. Power plants might need to ramp during critical events on short notice but aren't able to buy the fuel because pipelines allocate gas supply on an hourly or daily basis instead of minute-by-minute. Batteries can alleviate most of this pain, but it will be years before some grid areas have enough to overcome the inflexibility of natural gas supply.

Utilities will face other challenges as storage and renewables rapidly expand. These technologies are digital and fail differently than traditional analog systems. Software glitches can cause entire solar farms to go offline or batteries to charge and discharge suboptimally. PJM had teething problems with batteries in frequency regulation because some would automatically switch to charging once empty, counteracting other frequency assets. Grid operators might worry less about capacity tradeoffs and more about poorly written software or how automated digital systems might interact.

Markets can overcome lower levels of stored fuel, but there must be a concerted effort to fix bugs, send clear market signals, and push gas suppliers to be more flexible.

Adding Competition for Monopolies

Breaking Distribution Monopolies

Virtually all distribution systems are still closed. They are natural monopolies, and governments choose to formalize the monopolies and regulate them. Customers in some regions can choose a wholesale power provider, but they still must pay the distribution utility. Market wholesale prices have generally fallen, but customers' bills haven't because distribution charges keep rising.

Spending on delivery is growing rapidly; Source: EIA

A challenge for the US is that these distribution utilities are often extremely slow at connecting new electricity users. Distribution monopolies are a massive brake on growth if economic progress relies on new data centers, electrification of transport, and new industries.

Distributed energy co-located with customers is an obvious answer. Solar, batteries, fuel cells, natural gas generators, geothermal electricity, and nuclear microreactors are all angling for this business. These technologies provide market competition for distribution monopolies, and even nuclear proponents who advocate for full socialism in electricity production (to force the construction of nuclear power plants) are excited about the distributed electricity market opportunity. The distribution companies must provide service and cost comparable to or better than distributed energy competitors to retain customers.

Critics of these distributed energy technologies often complain about their cost or the erosion of high fixed-cost infrastructure. But most customers won't switch if the grid is cheaper with better service, and the grid should have all the advantages. The utility's lines already exist, it is convenient, it has payment and contact information for every electricity user, and its existing neighborhood infrastructure has around 25% utilization. Batteries and demand response can massively increase utilization as load grows and decrease service prices through fixed cost absorption. An organization deserves to die or undergo restructuring if it can't win with these built-in advantages.

Distributed energy technologies provide this competition whether there are wholesale markets or not. An expensive monopoly or a poorly functioning wholesale market will have a limit on how dysfunctional it can be.

Meta Competition

Utilities in regions of the US without electricity markets may not have direct competition, but nearby markets do affect their behavior. Regulators and legislators will crack down or force market liberalization if a utility demands rate increases faster than neighboring markets. I've heard from employees of monopoly-style utilities that the threat is real and impacts management decisions.

Independent power producers in wholesale markets mostly build natural gas, solar, wind, or battery projects. These all have fast construction time (<2 years) and predictable construction costs. Developers need these features to obtain reasonable finance costs from lenders. These projects, sometimes within regulated utility territory because of laws like PURPA, set the bar. Monopoly utilities often want to build large coal or nuclear power plants with longer construction timelines (>4 years) and much higher chances for cost overruns. They could traditionally force ratepayers to eat cost overruns. We see the new normal with South Carolina Gas and Electric and its V.C. Summer nuclear power plant debacle. Legislators forced the utility to eat most of the cost overrun, repealed laws that limited regulatory discretion for rate increases, and ultimately forced a fire sale of the utility to Dominion. Legislators, regulators, and utilities are still haggling over how much cost the utilities that own the Vogtle Nuclear Power Plant will have to eat.

Most monopoly utilities now shy away from mega projects that could impact their earnings or ability to continue as a going concern. New coal power plants are dead, and almost all nuclear interest has shifted to small modular reactors (SMRs) that put more risk onto power plant construction firms by limiting onsite construction. Utilities aren't signing binding agreements with SMR firms like NuScale because of the risk of being caught with cost increases.

Even imperfect markets curb the worst excesses of utility monopolies and force power plant designers to develop more market-friendly products.

Are Regulated Utilities or Markets Cheaper?

Proponents claim their regime is cheaper, but the data is mixed, and the differences appear small. It is easy to cherry-pick data for a viewpoint when underlying fuel costs or generation types can drive significant changes. Several factors contribute to the lack of separation:

Limited Load Growth

There has been close to zero increase in electricity demand in the deregulated era. Depreciated equipment is often the most affordable, so it is the same old power plants and owners. Some more meaningful market-driven changes came in Texas. Shale gas, wind, and solar have been murdering coal-fired power plants. However, many vertical utilities have also benefited from fuel switching from coal to gas.

Generation is a Small Fraction of Cost

Wholesale markets are less than half the cost structure. Significant cost improvements might only show up as 10%-20% changes to the customer.

Meta Competition Keeps Monopolies Close

Regulated monopolies can trim a little fat across the entire vertical to stay within a reasonable distance of nearby competition.

The difference in the last year or two is that load growth is back. Electric vehicles, factories, data centers, and heat pumps are increasing demand. Older power plants, especially coal-fired plants, are becoming untenable and require replacement. Demand growth combined with competitive non-fossil power plant costs shift markets from legacy generators to more numerous independent power producers.

The sea change will impact relative competition in several key areas:

The market power of incumbent generators will decrease.

Markets with unsound rules will get exposed.

California ISO and PJM Interconnect (Mid-Atlantic) are the poster children of flailing in this new age. They are struggling to connect new resources and incorporate new technologies. "Connect and manage" is rapidly gaining mindshare. People see Texans getting paid for their home batteries and wonder when they might be allowed to enter markets. Many change advocates are only beginning to process that many constructs like capacity markets or Federal Energy Regulatory Commission (FERC) driven rules are holding these markets back. I suspect Texas will only make these disparities more stark.

Vertical utilities face more pressure than ever.

Up to this point, utilities have been able to cut ~10% of expenses and still stay competitive. They've had similar access to cheaper fuel, like shale gas. Increasing load and shifting supply economics will increase the pace of change significantly. They must build new resources efficiently and will face more scrutiny in the rate-setting and planning processes. Distributed energy will also be a constant source of competition outside the few states where it is illegal. I'm optimistic that meta-competition will keep prices in check. Southwest Power Pool, Midwest ISO, and PJM are waiting in the wings for any laggards.

Technology drives much of the new competition, so its pressure is inevitable. A few regions with purer markets will put heat on the others. Distributed energy will exert strain everywhere. Utilities and grid operators must become more flexible to avoid reforms regardless of how they operate today. The key to it all is preserving these bastions of freedom.

Subsidies and Thumbs on Scales

Favoring any resource or adding complicated rules distorts markets by definition. At best, customers pay more through their bills or taxes. At worst, the market breaks like California in 2000-2001. Utility customers have limited tolerance for increasing bills or poor reliability. The responses from legislators and regulators aren't always optimal, but there will be action until the issue moderates.

Subsidies or favoritism have to be subtle enough that customers don't notice. Taxpayer-funded subsidies can be more substantial, but states are limited in how much they can borrow to fund such a program. Even the federal government is constrained, and it is hard to believe that Congress won't cut back subsidies if Inflation Reduction Act bills start skyrocketing while government interest payments are stacking up.

Governments can't ignore reality. The more they do, the more painful it is. Markets are simply the least worst way to get close to reality.

Learning to Love Markets

Digitization and cheaper batteries improve the efficiency and reliability of wholesale markets by handling trading and adding flexibility to supply and demand. The case for wholesale markets will continue to improve. Existing markets would work better if they simplified their structure and moved to energy-only. Thorny problems like capacity payments, paying demand response and distributed resources providers, and backlogged interconnection queues would be much easier to solve.

Vestigial distribution monopolies and arcane market rules will threaten economic growth as electricity grows in importance. Creating competition for utilities through distributed resources is critical to force them to improve their capital efficiency and reduce waiting times for new supply and demand.

The more the US embraces markets, the more affordable and responsive electricity provision will be.